Stock Markets are prone to bouts of irrational exuberance

THE CITY - the London investment markets.

The 'City' is the term commonly used to describe the mass of global financial institutions that make up the London financial markets. The vast majority of the major investment banks with branches in London are American or continental European owned.

First and foremost, the City is a classical market.

Markets have many common characteristics. They tend to be very communicative mini-societies, in which the insiders know a lot about what is going on and who is doing what. Any gathering of people who have broadly similar interests and ways of making a living will begin to differentiate themselves from other groups of people and develop a set of values that are commonly held amongst them.

Financial markets are no different. Historically, many of them were concentrated in particular cities or even particular quarters of particular cities, like Wall Street in New York, or Threadneedle Street in London. These days, electronic communications have made this unnecessary, but the availability of instant data on thousands of screens has if anything tightened the ties that link the players together.

International linkages are strengthened by the development of huge global investment banks, organizations employing thousands of people who are likely to hold common values and beliefs regardless of their nationality, whose training and skills have common roots, and who share similar goals.

So, what are the factors that indicate that the financial markets really do constitute closed working communities?

Such a list might well start with rewards. It has been reported that people who receive very high rewards for a particular activity come to believe that the things they do are very important and valuable. The availability of high rewards for particular forms of behaviour will tend to perpetuate and make it difficult to question them. For example, the total of bonuses paid in 2005 to some 300,000 people who work in the City is reported to be in the region of £19 billion. Many traders, analysts and particularly investment bankers earn multi-million sums in an average year and multiples of this in boom times.

Reward in the financial markets is internally determined. There is no reference to outside bodies that might be able to have a moderating influence, or feed in challenging perspectives. Therefore, several things seem to have happened.

Firstly a lot of people whose roles and skills strike external observers as not being very special seem to be hugely rewarded.

Ah, say some, but what about the value created by good operators in the financial markets. Surely market forces will determine rewards? Well, once again, there is evidence of self-determining system at work. Take investment bankers' fees for instance.

Rule 3 of The City Code on Takeovers and Mergers stipulates that, in the event of a takeover bid, the "Board of the offeree must obtain independent competent advice on any offer and the substance of such advice must be made known to its shareholders". Important shareholder protection no doubt, but it also ensures that members of the 'market' get a guaranteed crack at the huge fees incurred in deals.

So, why do corporate managers not simply refuse to pay so much in fees? Many managers believe (rightly, as will be seen in subsequent sections) that they need the goodwill of the markets to be employable in a senior job. Martin Dixon, in the Financial Times of 6 January 2001 writes; "....the sums involved (in investment banker's fees) border on the obscene. For example, Blue Circle in 2003 spent some £27 million on advisers - roughly 10% of annual pre-tax profits, a not untypical figure - as it successfully defended itself against Lafarge. (Not very long after, Lafarge and Blue Circle, again with expensive help from both their advisers reached agreement on the takeover and Blue Circle passed into French ownership.) Nor are fees obviously related to an adviser's input to a bid......so how can bankers get away with it? Two reasons - their oligopolistic powers and their clients' fear".

To summarise the situation, the players in the financial markets reward themselves very richly by comparison with other professional workers and raise the money to do this, at least in part, by extracting huge fees from clients and customers.

Closed systems are often cut off from the outside by shared systems of belief and patterns of expression and thought that exclude anything uncomfortable, a symptom of 'Groupthink'. Bodies of people become capable of persisting with patterns of thought and action that are damaging or irrational, despite strong external evidence. Also, groups of people may develop forms of expression amounting to a local form of political correctness that may deny or twist the truth because it is uncomfortable.

Is there evidence of such syndromes in the financial markets? Almost certainly.

Probable manifestations are the strong tendency towards herd-like behaviours and espousing of fads and crazes. In the short term, rumours can cause quite violent swings in share prices, even if they often seem far-fetched to outsiders. Some rumours are almost certainly started deliberately and some are simply the product of a rather nervous herd mentality. We must all have seen a flock of sheep suddenly seized by a momentary panic!

To quote George Soros in The Crisis of Global Capitalism, "The belief in fundamentals is eroding and trend-following behaviour is on the rise. It is fostered by the increasing influence of institutional investors whose performance is measured by relative rather than absolute performance and by the large money center banks that act as market makers in currencies and derivatives. They benefit from increased volatility both as market makers and as providers of hedging mechanisms."

There is a strong tendency for market behaviour to exaggerate the natural cyclical ups and downs of economic growth. In bull markets, over-optimism rules and both markets and companies behave as though boom conditions will last forever. Companies indulge in deals and transactions that will need to be undone the moment the market steadies.

Overpayment for acquisitions becomes rife. Value is destroyed by foolish and risky strategies. Greed becomes rampant, great pressure is exerted by investment banks to exploit the good times through excessive growth, and weird theories heralding the end of cyclical downturns are fervently believed.

Once the inevitable pause in growth occurs, the effects are exaggerated as all the mistakes hidden by the boom come home to roost. In these early years of the twenty-first century we have seen many of these manifestations.

Last, there is a strong tendency for the society that is the City to reject those who might threaten prevailing norms and beliefs, or who might be different to the herd. As the herd is predominantly male, there are many instances of women claiming oppressive and discriminatory behaviour by their male colleagues.

The main actors in the investment markets.

Investment Institutions.

At the centre of the City/Company nexus are the investment fund managers, also called institutional investors.

Investment institutions are many and varied, but their functions tend to be similar. They take other people's money and invest it, according to published or agreed criteria, in theory to make the highest returns they can for their clients. As clients have a multitude of objectives, for example capital appreciation versus cash income, low versus higher risk, short versus longer timescales, so the strategies of investment institutions' various funds will tend to cover a wide spread.

Pension funds still occupy the centre of the investment stage and it is worth examining pensions investment to generate some understanding of a cycle that ends up by placing huge pressures on companies to deliver continuous above average performance.

Despite the much-publicised withdrawal by many companies from final pay pension schemes, company and individual pension schemes will for the foreseeable future generate massive flows of cash to be invested in the capital markets.

A typical larger company pension fund will have a board of trustees. Trustees are in general part-time and not well equipped to cope with an increasingly complex world of pensions and investment - they are therefore very dependent on advisers of various kinds, who may have their own axes to grind.

Their role is to protect the rights of employees who are members of the pension fund. One function is to ensure that the member's funds are prudently invested, so that future pensions can be paid.

In reality, over the last decade or so, this has come to mean that pension fund trustees judge their investment managers by whether or not they are able to beat an average or index. The pressure tends to be increased when top managers are a significant influence in trustee boards, because they will also want to maximise profits so that the cost of the pension fund to the company will be kept as low as possible.

Fund managers whose investment performance falls below that of the chosen comparators tend to be replaced. The few old-timers left in fund management contrast today with a past environment when indices were less important and they were given much more time to rectify a performance lapse. As fund managers typically report four times a year on their performance, two bad quarters will place extreme pressure on them to 'do something'. They also know full well that the financial adviser to the pension fund will have a list of alternative fund managers readily available.

So what in times gone by tended to be an alliance between fund manager and company based on relationship and performance has become one based on short term performance alone. This is one start point of a cycle of pressure that has totally transformed the relationship between large companies and their investors.

What drives the Investment Institutions?

Investment management is a competitive business. It is also a business in which the "stars" can make very big money and wield great power. Messages from fund managers to CEO's are not easily ignored.

As has been indicated, the investment industry abounds with indices, league tables and other devices that purport to measure the comparative performance of funds in relation to their rivals. Relative performance is crucial, because that will strongly influence the success of an institution in attracting funds from investors.

The size of the Funds Under Management will determine the fees earned by an institution and in turn by its managers.

One side effect of this measurement against an index or average is herd behaviour on the part of institutions. So great is the fear of mistakes in investment policy that the behaviour of the large institutions tends to converge, with everybody seeking to stay with the crowd and gain small advantages at the margins. This means that the City lacks the variety of investment strategies found in the much larger US markets.

Some investment managers, often called value investors, will look for investments they calculate to be under-valued in relation to their long-term prospects and then hold them for the long term. However, such is the pressure generated by pension funds and by the prevailing culture, it is not surprising that institutional investors in the main tend to take a short term view and be very active in changing their holdings. This is, after all, the way in which they themselves tend to be measured. Thus companies that diverge from expectations tend to feel the heat from investors quickly and intensely.

Index tracking and Hedge Funds.

The investment markets have in recent years seen the massive growth of two opposing types of investor - passive, or Index investors, who simply follow the market index, placing their shares in the market weighed by industrial sector. These passive funds can be contrasted with active fund management, where managers seek to beat the index by selecting shares they believe will be winners, and frequently shuffling their share portfolios to beat the market, which most completely fail to do. Active fund managers charge far higher management fees than their passive brethren.

Passive or Index funds invest in the stock market, tailoring their holdings to match the profile of a chosen index, say the FTSE 100. Performance of these funds should closely follow that of the chosen index. Theoretically, in the long run, tracker funds will perform as well as active ones, because no active fund will beat the average forever. In practise, one effect of such funds is to increase the volatility of share prices, as they are forced to buy and sell to match the profile of the market. Therefore, for example, when Vodafone made its massive £110 billion acquisition of Mannesmann, thus vastly increasing that company's market capitalisation, tracker funds had to sell other stocks in order to purchase Vodafone. Up went Vodafone, down went the others, for reasons totally unconnected with their underlying performance.

Another massive source of potential instability is Hedge Funds. These are funds that set out to beat the market by using a range of unusual and often highly speculative investment strategies.

'Hedging' is a term used for offsetting risk. Typically they 'hedge' by offsetting 'short' positions (borrowing shares and then selling them at a higher price) against 'long' positions (borrowing money to speculate on undervalued shares).

As Hedge Funds are not subject to the regulatory regimes of the stock markets, they are free to indulge in a vast range of often highly speculative investment devices - to the extent that nobody really understands the potential for destabilising the international financial markets of vast amounts of short-term speculative money circulating in the system. We will probably see come the next recession, when many highly leveraged and risky funds may collapse, possibly dwarfing the dot-com crash.

Hedge funds are mainly used by very wealthy individuals and massive banks - they are often based offshore to avoid tax and regulation.

Images of the City : As a Horn of Plenty for all

What are Fund Managers Good At?

One of the stockbrokers whom we interviewed was quite sure that the City in its various manifestations knew everything that mattered about business.

He said that increasing specialisation within fund management meant that investment management decisions for individual companies are being devolved within institutions. This in turn means that CEO's are being increasingly exposed to younger fund managers and are often upset by being grilled by 27-year-old's. "What the CEOs' don't realise", he said, "Is how good these youngsters are".

Fund managers intelligence on companies comes from a variety of sources. Prime amongst them is presentations made to investors by the top managers of companies. Large companies will typically present twice a year.

Much store is placed on these presentations. In addition to the information presented on strategy and performance expectations, managers get rated on substance and style. Such issues as: are they telling a good 'story'; how well do they appear to know the business; how good they are with 'The Numbers'; how confident do they appear to be, how committed to producing what investors want; are believed by investors and analysts to help them develop informed judgments about companies and their management.

As a direct result of these and other private and public encounters, CEO's, Finance Directors and sometimes Chairmen, are informally rated by investors. Thus is a considerable circulation of gossip created about senior managers. This gossip is often couched in familiar terms, with the subjects often being referred to by their first names or nicknames, rather in the style of 'Hello' magazine! Perceived confidence, presentation skills and reputation management assume great importance.

Secondly, a huge amount of financial and anecdotal information is generated by "Sell-side" analysts, who generally work for stockbrokers and produce publicly available research on companies, in addition to specially commissioned studies. However, owing to developing suspicions that "Sell-side" analysts were becoming biased in their analysis by the pressures to sell the services of the investment banks and stockbrokers that employed them, institutions have developed analytical skills of their own. Institutional investor's analysts, commonly known as "Buy-side" analysts, tend not to publish their research. Many believe that this makes it more impartial.

Then, institutional investors have access to the enormous information machine, created by banks, researchers, specialist institutes and agencies and PR companies, that supports the financial markets and press. To this must be added the already mentioned rumour and tittle-tattle that inevitably gets generated in a complex, competitive market, where getting in first with a juicy piece of information may generate a veritable fortune.

So, what skills do institutional investors deploy to make sense of the huge pool of available information and understand the companies in which they might invest?

Managers and people in the financial markets tended to diverge sharply at this point.

Managers felt that investors are excellent at all forms of financial analysis and have a good understanding of industry economics and competitor analysis. In addition, they have a great deal of specialist knowledge about the economics and structures of particular industries.

However, many managers were also strongly of the view that there is an almost total lack of understanding of the processes of managing and developing effective organizations. It would not be putting it too strongly to say that they generally believe that they are dealing with very bright people with a good theoretical business education and with an accounting or banking bias. However, they also feel that these individuals understand little, and care less, about the more intimate and complex matters of leading and managing a large enterprise.

Thus they are naïve, intolerant and disinterested in the realities of leading large companies.

One very senior manager declared that he was leading a process of quite radical organization change that, when complete, would significantly enhance the performance of the business. Because the process of change was long and complex, he had no intention of even mentioning it to investors until it was beginning to generate tangible results. They would not understand it, said he.

Another of our interviewees, a very experienced and successful CEO, declared that 'they don't understand how a business works'.

Some managers commented that institutional investors tend to categorise companies by "A headline, three bullet points and a profile of the chief executive". Managers thus tend to communicate with the markets in these terms.

For example, one manager (with tongue in cheek) expressed his strategic objectives in "City" terms as:

Year One - Consolidate

- Bring order to mess left by predecessors

- Reduce stocks

- Reduce staff

- Manage cash

- Fill holes in management

Year Two - Profit Recovery

- Use new systems to focus ordering and branch stocking

- Consolidate product lines.

- Close unprofitable branches

Year Three - Return to Growth

- Exploit strong brand and customer loyalty to open new branches

- Develop new product lines

- Leverage franchise opportunities

The same manager also commented that the other ingredients for success with investors include "Telling it like it is", keeping it short and simple, confidence, quick wit, being good with numbers and making it clear that the interests of investors were paramount. He expressed the latter point as "Making it clear that I will do anything to meet their agendas".

City interviewees agree with managers about the primacy of industry, market and financial analysis, but feel that they understand a great deal about managers, organizations and management. However, their focus seemed to be on a few individuals, they described organizations as "the structure" and think of management as consisting of decisive actions by the leadership figures with whom they are familiar.

Images of the City : as a fortress defended from democratic influence

What do the Institutions want of companies?

First and foremost, they want managers to think and act as though their interests and the interests of investors are synonymous. Then, they want complete openness in reporting, so that they can avoid being unpleasantly surprised.

Fund managers' ideal companies will produce above average growth, year in, year out. Sir Clive Thompson, the ex-CEO of Rentokil Initial plc, was for many years known as "Mr Twenty Per Cent" and much lauded for continually delivering an annual growth rate at or above this magic figure. When the company fell over a performance precipice as a result of underinvestment, poor customer service and employee exploitation, Sir Clive plunged almost instantly from grace - the 'Hero to Zero' effect.

There is a preference for companies that produce the desired rate of growth by "active" means. Institutional managers along with investment bankers and stockbrokers, tend to feel that "active" managers, those that make acquisitions, do deals, cut costs and so on are more decisive and able than their colleagues who keep their heads down and stick to their knitting.

However, double-digit organic growth will do as second best. One of the managers whom we interviewed made the point that investors are not necessarily short term in outlook. He said that, provided it was supported by a good "story", a long-term investment strategy could attract investor support. He slightly spoiled the effect by then saying even one slip from the promised programme and results could lead to in a rapid withdrawal of support, as investors hate uncertain long-term payback more than anything.

Companies with modest and cyclical growth are labelled as "dull" and tend to lack support. One person we interviewed described Rolls Royce plc as a "Boring Midlands engineering company".

Investor support is rather fickle. Companies that falter or, even worse, promise a particular rate of growth and 'fail to deliver' will be severely punished.

Here are some of the factors that institutional investors like, according to our interviewees and writers such as Tony Golding:

- Focus and commitment to a core business. Therefore, 'non-core' activities should be de-merged, spun off or carved out. Not so long ago, a degree of diversification was approved of. Fashions change.

- Managing businesses like an equity portfolio. In effect, this means a high degree of corporate activity, and particularly, regarding the enterprise that they lead as group of "assets" that can be shuffled, bought and sold.

- 'Biddable' companies. They intensely dislike anything that might prevent a company from being acquired, and like to feel that there could always be a bid for their holding in a company.

- A clear 'strategy'. This means an easily understandable way of keeping future earnings moving ahead. We have previously mentioned a distinct liking for a high level of M&A activity as part of a good strategy. Strictly speaking, large acquisitions ought to be regarded with suspicion by institutional investors, not only because of their value destructive history, but also because if new shares are issued, there is a risk that future earnings per share may be "diluted" (bad word). However, it is at this stage that "synergy", (good word), can come to the rescue.

Companies planning a big acquisition will invariably issue a list of expected merger synergies, and investors will usually vote in favour. Acceptance will be made easier in large integrated investment banks, because the investment banking and stockbroking arms will benefit from acquisition-generated fees. - Moving on and forgetting yesterday. This factor means that investors tend to have very short memories and are always looking for the next opportunity. It also means a very distinct preference for dealing with problems by transactional means. It is regarded as better to divest or close a troublesome business than to manage it out of trouble.

The contrast of these values with the investment philosophies of Warren Buffet, the durable guru of Berkshire Hathaway, could not be more stark. Here are some of Buffet's investment tenets:

- Always invest for the long term

- Buy companies with strong histories of profitability and with a dominant business franchise

- Risk can be greatly reduced by concentrating on a few well understood holdings

- Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.

- Lethargy, bordering on sloth, should remain the cornerstone of an investment style

- Wild swings in share prices have more to do with the "lemming-like" behaviour of institutional investors than with the aggregate returns of the companies they own

- Do not take yearly results too seriously. Instead, focus on four or five year averages.

- Buy a business, don't rent stocks ("shares", in the UK).

- Look for the business with a consistent operating history

- Remember that the stock market is manic-depressive.

Why the differences? Maybe the main one is that Mr Buffet and his partner have been leading investors since the early 1970's and have quite different life and investment philosophies to 30-year-old's who want to be rich quickly and believe that they are only as good as their last two quarter's results!

Readers might like to reflect on the likely differences top managers would experience if a major stakeholder in their company was Berkshire Hathaway or a proficient value investor.

Images of the City: As a Cuckoo in the UK industrial nest

Investment Bankers.

Investment Banks are often referred to as "Advisers". Their main functions are to assist corporate managements in preparing strategies for financing their businesses, to value deals that managers may wish to make and to support companies in planning and executing transactions, such as acquisitions or de-mergers.

Investment Bankers make most of their earnings from corporate finance transactions, including mergers and acquisitions. In good years, when there is a high level of corporate "activity", top bankers can earn massive fees.

Rule 3 of the City Takeover Code requires the Boards of Directors to obtain competent independent advice when mounting bid defences. An investment bank will invariably be retained for this service. Given that the bidding side will also be 'advised', it is no wonder that these banks thrive on 'active' management.

In addition to the lure of big money, deal making brings additional benefits to the players involved. For some people, the buzz bestowed by working intensely with top managers on deals that will change many people's lives is irresistible.

Bankers are very active in promoting deals, usually by creating 'ideas' and 'strategies' for acquisitions, mergers and de-mergers that will be actively sold to potential 'customers', including top managers, investment institutions, the press and any others who might have influence. An experienced City lawyer estimated that investment bankers initiate 50% of all acquisition proposals. The banker's cause is likely to have received a considerable boost as a result of the development of the large integrated American investment banks.

Investment bankers had a mixed reputation with the managers we interviewed. Some older, more senior individuals are well rated and trusted. Their advice is respected and listened to, and it is felt that they can put the interests of companies and managers before their own. Such individuals are also felt to have considerable influence when it comes to managers' career and employment prospects.

But, managers mainly felt that the majority of bankers were aggressive, ambitious and money-driven people, albeit very intellectually able. A business school professor we interviewed, asked to develop and run business strategy programmes for younger bankers, commented that whilst very bright, most were almost totally analytical and convergent in their thinking. He said that if they were presented with ambiguity or what they saw to be excessive complexity, they became aggressive and sought to find quick and clear solutions. He described them as bright "puzzle-solvers", who tended to become frustrated if faced by long-term, ambiguous problems.

There is also a somewhat sinister side to the promotion of 'deals' by investment bankers. We have already seen how much psychology is tied up in deal making - greed, fear and ego. One leading Investment Banker described some of his colleagues as "good at capturing the wishes and views of the Chief Executive, then leading him where they (the bankers) want him to go". Inevitably this will be in the direction of deals, and consequently fees.

Unlike institutional investors, the Investment Bankers seem to be in a 'no lose' situation. Whether the deal is a good one or not, they get their fees. If it's a good one, then they are in a position to recommend the next deal. If it's a bad one, then there may well be a disposal to handle.

In fact, as John Plender writing in the Financial Times put it, "What a business - fees for putting Humpty on the wall, fees for pushing him off, fees for putting him back together again".

Stockbrokers

The prime function of Stockbrokers, as their name implies, is to buy and sell shares on behalf of private, institutional and corporate customers. They make their money from the volume of share transactions that goes through their company.

Most of the "Sell-side" stock market analysts are employed by broking companies. The higher the reputation of the analysts, the more business it is felt will be attracted to the broking company. Brokers also employ specialist salesmen to push shares to investors.

Many listed companies retain a broking company as the 'house brokers'. This means that the broking company will be at the forefront of all new share issues. More important, the house broker is likely to provide private advice and guidance to top management on how to handle relationships with investment institutions and the financial markets generally.

The ability to develop good and trusting relationships with managers and all other players in and around the financial markets is of crucial importance to brokers. Senior stockbrokers, who are well known to anybody who understands the markets, are important sounding boards of City opinion on top management appointments and thus wield considerable informal influence.

"Sell-side" Analysts.

Analysts have been the object of much adverse publicity in recent times.

The function of researching companies has only been established as a serious professional activity for 20 or so years. The main focus of analysis and company research has been to provide investors with good insights on companies' performance prospects through analysing their strengths and weaknesses with reference to competitors and markets. A good analyst, through personal contacts with top management, could go some way to ensuring that fund managers saw trouble coming in time to do something about their shareholdings. This ability was of great value to investors and rewarding to analysts. Conversely, if analysts got it wrong, it could be seriously damaging to their income and reputation.

Analyst's reports, which have a distinct financial bias, go into considerable detail about many facets of a company's activities, and usually result in a recommendation on what attitude investors might assume towards owning shares. Increasing professionalism brought analysts power and influence, to the extent that good analysts became a source of competitive advantage to the broking houses that employed them. Top analysts became stars in their own right and commanded star rewards. In the early 1990's, through their influence on investment institutions and their contacts with top managers and special relationships with the press, top analysts were felt by managers to wield considerable power. The support of a top industry analyst was decidedly career enhancing, even for well-established managers.

Trouble for analysts as a breed really seemed to begin with the development of integrated investment banks. It did not take long to see that a good analyst could attract business to the broking side of the business, but more important, their reputations and knowledge could also attract more deals to the investment banking arm. Thus, analysts started to be rewarded for the volumes of business they attracted to the bank. In other words, they became regarded as promoters of the overall business. This led to questions about the objectivity of their analyses, and to the gradual build-up of the capability to do independent analysis by investment institutions.

More recent events have tarnished the reputations of "sell-side" analysts still further. They have been accused, in the US in particular, of pushing the sale of shares in dubious internet companies to private investors, making billions of dollars for their employers and leading many investors to lose their shirts.

The publication of a number of explosive e-mails from one Merrill Lynch analyst expressing negative opinions about shares he was recommending has confirmed the long held fears of many about analyst's objectivity.

This episode and others similar have dealt yet another blow to the already tarnished ethical reputation of the financial services industry. It is not yet evident whether the same practises are prevalent in the London market, but the same organizational arrangements tend to prevail, and the industry is considering whether to restructure in order to restore confidence.

The Financial Press.

There are many excellent financial and management journalists. At random, we would pick out Anthony Hilton, The Financial Editor of the London 'Evening Standard', and most of the financial editors of the British broadsheets, together with management journalists such as Simon Caulkin of the 'Observer', as representing informed and thoughtful perspectives on the world of business.

However, we would also comment that the average standard of financial journalism is, in our view, trivial, sensation-seeking and of deplorably low quality. The press in general has a very strong tendency to represent business as a sort of soap opera dominated by heroes and villains. The fact that many elements of the press are closely networked with other players in the financial markets and management makes their influence on managers very strong, as many a top manager who has simultaneously got on the wrong side of investors, stock market analysts and influential journalists can attest.

We would pick out two strong proclivities manifested by the press, as well as by the financial markets, that have a generally negative effect on the business environment.

The first one is a marked tendency to reduce the world of large businesses and the inevitably complex organizations that support them to a few larger than life individuals.

Here is an example.

It concerns Sir Graham Wilkins, an individual known to the authors, who died on July 2, 2003. Sir Graham was chairman of Thorn EMI plc at a time that we were both working for that then troubled company. We would start by saying that Sir Graham was well regarded personally by all who came into contact with him.

He was projected into the role of chairman from non-executive director following the sudden dismissal of Peter Laister as chairman and chief executive, after a period of hyperactivity in which Thorn EMI (itself the result of a 1979 merger) attempted to create a merger with British Aerospace and did make the acquisition of Inmos, a semiconductor manufacturer, which proved to be a financial disaster.

The writer of Sir Graham's obituary says, "While his predecessor at Thorn EMI had gained an unfortunate reputation for prevarication, Wilkins was focused and decisive". (How trying to engineer the biggest merger in British industrial history could be construed as 'prevarication' beggars the imagination!)

The writer goes on to say, "Recognising that there was excess capacity in the television manufacturing industry, he restructured Ferguson and cut a thousand jobs. He made management changes at Inmos, Thorn EMI's struggling semiconductor business, and supervised an overhaul of the roster of artists signed by EMI, which had become unbalanced".

The reality of the matter was that the board appointed Colin Southgate as Managing Director at the same time as Sir Graham became part-time chairman. Southgate, with a growing group of new appointees whom he and his colleagues brought into the company at corporate and business group levels, instituted an extensive and detailed review over several years of the whole range of Thorn EMI's many businesses. The key to the success of the turn-round of Thorn Emi's fortunes was very detailed operational knowledge and focused improvement and restructuring programmes, together with extensive disposals, conducted by a large cast of corporate and operating managers, led by Southgate.

Sir Graham was a million miles away from this operational and detailed knowledge and played no part whatever in the restructuring of individual Thorn EMI businesses. He did, however, provide valuable overall support and in particular added weight to a relatively inexperienced corporate team in communicating with the financial markets.

The damaging aspect of the journalists' spin is to mislead readers into believing that chairmen and boards can do any more than support or challenge those who do understand and know the business at a level of detail to make sensible decisions. But, above all, such journalism lends weight to the extremely damaging assumption that industry is run by superhero individuals and not by large groups of people managing large and complex organizations.

From this misconception can flow many other evils, such as an assumption that complex problems can be 'fixed' to ridiculous timetables. This latter tendency has come to pervade the whole of our society.

The second tendency can be exemplified by a fictional headline, "Gripfast Industries has another good year, and continues to be well managed."

Readers may protest that they have not often seen such a headline in the financial press, and they will be right. Such news is not 'news' at all and certainly will not be felt by journalists to sell newspapers. Most journalists need stronger meat than that. High profile hirings and firings, corporate scandals and disasters, big moves and deals, these are the daily meat of many sections of the financial press. And because yesterday's news is not news at all, there is a strong tendency to characterise the world of business as a series of high profile actions, big decisions and bold moves, rather than the warp and weft of managing a business from the basis of detailed involvement in operations, which research shows to be the basis for good management at both strategic and operational levels. Thus, large sections of the financial community, supported by the press, have developed a 'move on and don't look back' mentality, which almost certainly blocks learning from experience.

Endpiece

The City is not really a British institution - it ceased to be in the years after 1986, when UK financial institutions failed to respond competitively to the 'Big Bang' deregulation. Now it can almost be characterised as a state within a state, rather like a modern version of the medieval Hanseatic League. Such is the power of the system of global investment banking that the UK government has virtually no influence over the trends that emanate from the market.

Political commentator Martin Kettle commented: "But the big relationship between politicians and the City is more profoundly unequal today than for decades. The Big Bang marked the moment when democracy let slip whatever grip it may once have had".

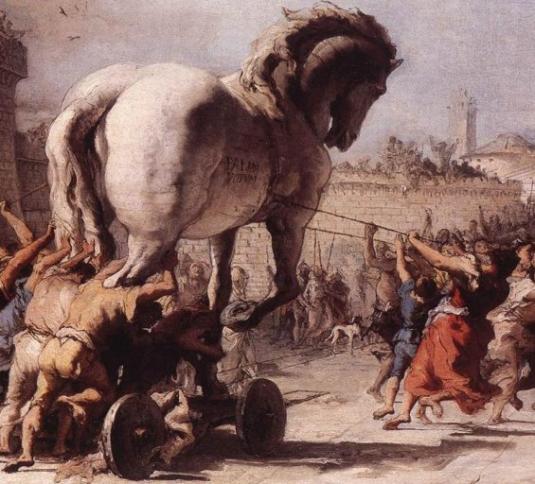

London is attracting more and more foreign enterprises which use the relatively lightly regulated environment to their benefit. It may in time become a sort of Trojan horse for the ambitions of such as the Russian and Chinese states. There is no way that the rash of often state-controlled Russian companies coming to London are going to be bound by UK corporate governance, no matter how many lords they have on their boards.

Being in reality virtually powerless to influence what happens in the City, and probably mindful of their own post-political careers, UK politicians make the best of it and lavish praise on the financial markets as being the jewel in the UK economic crown.

But is this the case? The truth seems to be much more complex. London is certainly one of the most important hubs in the global financial system, and much benefit flows from this. The wealth created by the City certainly enriches London and benefits the UK economy more broadly, in terms of exports and the balance of trade. London is also a centre of financial expertise, with all the highly paid employment this creates.

But there are also massive downsides, as will be discussed through this site.

The increasingly speculative and short term nature of the investment markets is wreaking great damage on the non-financial parts of the UK economy. Results are underinvestment and debilitation of many larger British companies in competitive markets and the sale of whole industries to foreign buyers, with no concern for the longer term national interest. The predilections of the London financial markets to resist investment in technology and innovation is undermining the UK's competitiveness in modern industries.

So, paradoxically, the stronger and more dominant the City and the more dependent the UK becomes on the finance industries, the weaker the indigenous economy becomes. We are heading rapidly towards a seriously unbalanced economy - the main sufferers being advanced technology industries that form the bedrocks of most developed countries' economies. The huge success of the London financial markets draws resources from other parts of the UK and inhibits development of modern enterprise in the rest of the UK. The analogy of the Cuckoo in the Nest is not totally inappropriate.

Maybe the answer is to strengthen the ability of other UK regions to support and nurture their economies, using sources of finance that are not dependent on the global financial system and the City. As an example, Ireland succeeded in launching its new economy mainly on EU funding. This is probably the best case for UK political devolution. So, longer term, the answer may be to strengthen other facets of the UK economy rather than attempting to seriously change the City.

Images of the City: As a Trojan Horse for foreign interests